- #ALEX WATERFALL ASSET MANAGEMENT LINKEDIN LICENSE#

- #ALEX WATERFALL ASSET MANAGEMENT LINKEDIN PROFESSIONAL#

Similarly, CLA Global Limited cannot act as an agent of any member firm and cannot obligate any member firm. CLA (CliftonLarsonAllen LLP) is not an agent of any other member of CLA Global Limited, cannot obligate any other member firm, and is liable only for its own acts or omissions and not those of any other member firm. CLA Global Limited does not practice accountancy or provide any services to clients. Each CLA Global network firm is a member of CLA Global Limited, a UK private company limited by guarantee.

#ALEX WATERFALL ASSET MANAGEMENT LINKEDIN LICENSE#

If you have questions regarding individual license information, please contact Elizabeth Spencer.ĬLA (CliftonLarsonAllen LLP), an independent legal entity, is a network member of CLA Global, an international organization of independent accounting and advisory firms. The North Carolina certificate number is 26858. The Minnesota certificate number is 00963. Waterfall is also the external manager to Ready Capital Corporation (NYSE: RC), a multi-strategy real estate finance company and small business lender.CliftonLarsonAllen is a Minnesota LLP, with more than 120 locations across the United States. As of April 30, 2022, Waterfall manages $10.65B in AUM.

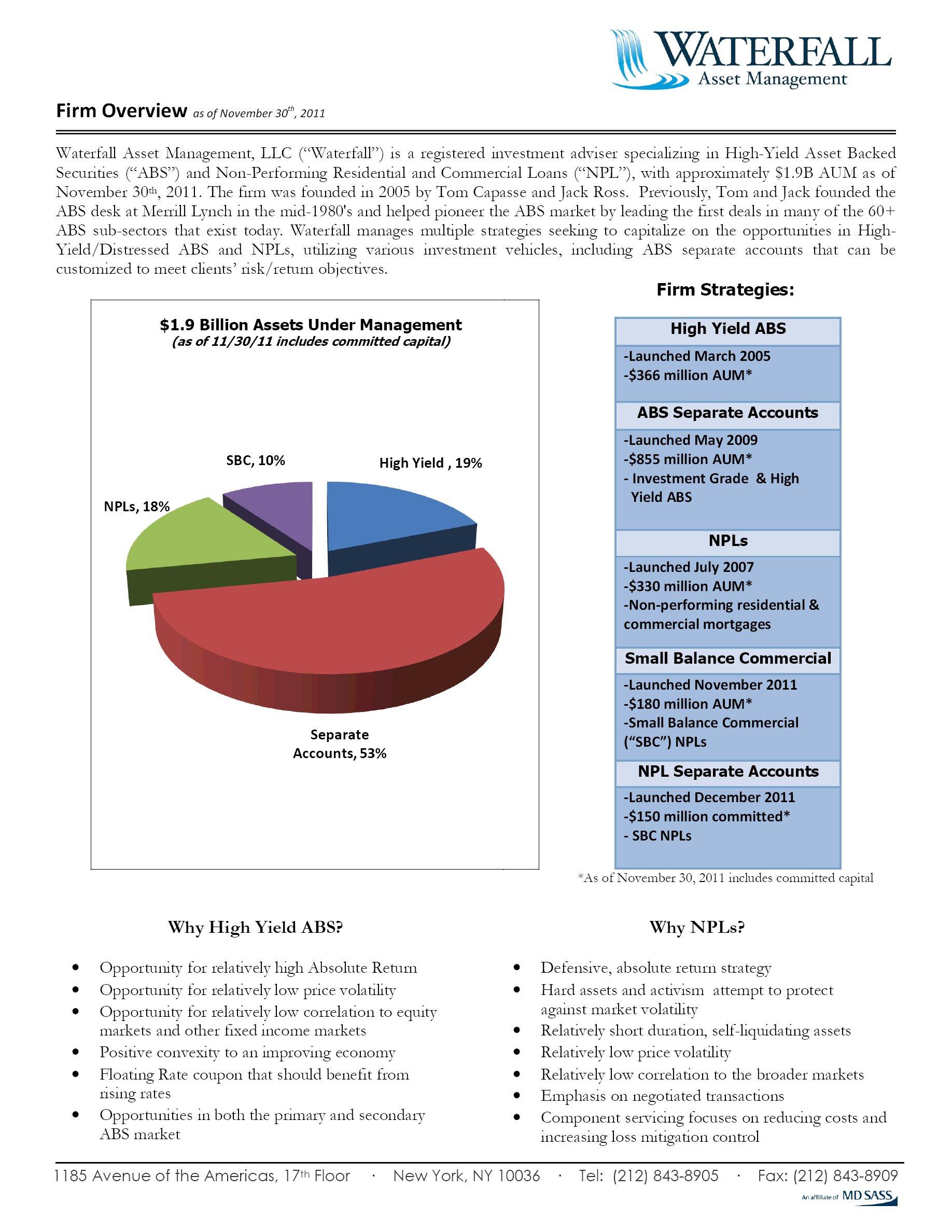

Founded in 2005, the firm employs a differentiated relative value approach to investing and extensive asset-backed credit expertise to offer compelling investment solutions to its clients. Waterfall Asset Management is a New York-based investment manager focused on structured products and private equity investments. Waterfall’s Hong Kong office is the firm’s fourth office globally, alongside its headquarters in New York, and operations in London and Dublin. His expertise and relationships will be of immediate value for our firm and his passion for investing and working with colleagues and counterparties on crafting bespoke solutions to complex financial needs make him an outstanding fit with our firm’s culture and mission.” Lo said, “Alistair brings nearly two decades of experience leading and investing in structured finance transactions in the APAC-region and we are excited to welcome him to the firm. Ho will report to Patrick Lo, Partner and Head of International at Waterfall. He currently serves on the Board of Managers for the Hong Kong International School. Ho earned a master’s degree in Economics and a bachelor’s degree in Economics and Finance from the McGill University, and a master’s degree in Quantitative Finance from the University of Waterloo. Prior to that, he held senior positions in APAC offices for Ostrum Asset Management, Mizuho Securities Asia Limited, Credit Suisse and Citigroup, after starting his career in the Structured Credit Products Group at Citigroup in New York. Ho joins Waterfall having previously led Natixis Investment Managers International Hong Kong Limited. Additionally, with our deep expertise and ability to craft flexible capital solutions we believe we have considerable competitive advantages as we pursue that opportunity on behalf of our investors.” Driving team growth while pursuing investor / client retention initiatives. There is a tremendous opportunity for private debt offerings and opportunistic financing across the region, particularly with its growing middle market and regulatory changes. Sixteen years of progressive real estate operation / development experience. Waterfall Co-Founders and Managing Partners Jack Ross and Tom Capasse said, “We are thrilled to continue our global growth by establishing a physical presence in Asia. Waterfall’s Hong Kong office will focus on identifying opportunities to leverage the firm’s differentiated capabilities in structured and securitized markets to provide private debt solutions for APAC non-bank financial institutions, middle market corporates and real estate-related borrowers. Alistair Ho, who recently joined the firm as Managing Director and Head of Asia-Pacific (“APAC”), has more than 18 years of experience in the region’s credit markets, will lead the office. New York – Aug– Waterfall Asset Management, an alternative asset manager, today announced the establishment of its Hong Kong office to enhance its capabilities in the Asia-Pacific region.

#ALEX WATERFALL ASSET MANAGEMENT LINKEDIN PROFESSIONAL#

Experienced Credit Professional Alistair Ho to Expand Operations of Waterfall’s APAC Investing Business

0 kommentar(er)

0 kommentar(er)